It is difficult to separate the signal from the noise when gauging economic barometers, taking guesses now that will most certainly be proven wrong later. And today may have been just another one of those days when false negatives and false positives meld to form a most beautifully inaccurate picture for investment pundits — just another blip on the radar — or we may have witnessed a key structural milestone in a global energy economy centered around oil. The downward trend in oil prices over the last two years has shown to have had a dampening effect on equity prices since the fallout began towards the end of 2014. And so almost any trading day oil prices ended lower, there was a good chance equity markets ended lower as well.

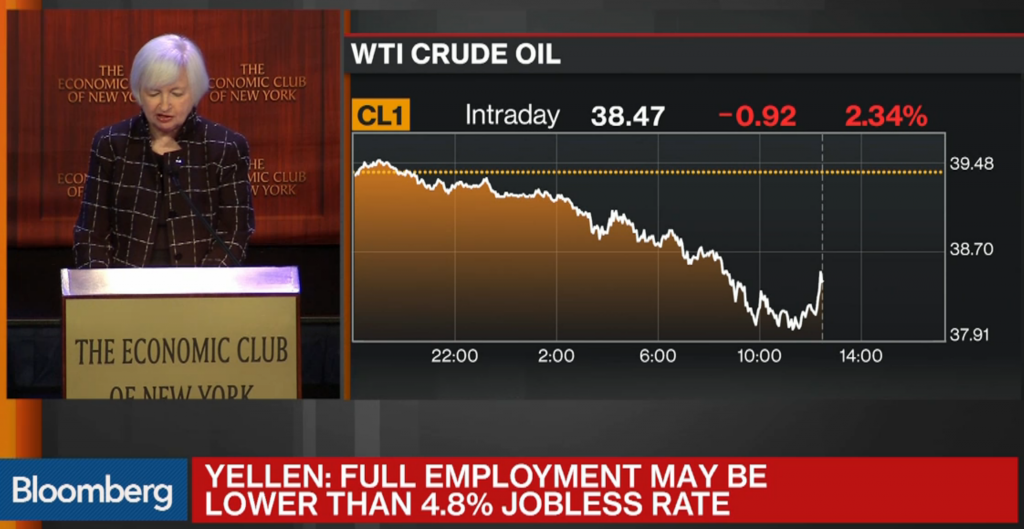

But today was different, both in magnitude and timeliness. Oil prices fell, but equities rose. Crude dropped by nearly 3% [1], but the S&P 500 was just shy of a 1% gain and the Dow rose over half a percent. Small caps did even better with the Russell 2000 Index jumping 2.7% [2]. Now one huge confounding variable in today’s trading were remarks made by Fed Chair Janet Yellen, but taken into account suggest that monetary caution is still at play and so nothing has materially changed (or will change) as far as interest rates and money supply could affect asset prices across the board over the next few months. The irony was that in those very moments that Yellen warned investors that lower prices could continue to hurt the economy, equity markets reacted just the opposite of what’s expected when one inflicts pain onto another. In fact the S&P 500 hit a year-to-date high while crude oil straggled. The only harm done by weak oil prices today seems to have been self-inflicted and well-isolated from broader macroeconomic trends.

A divergence in two commonly correlated benchmarks may be occurring. Monetary policy aside (a not-so-modest thing to say), if today is any signal, it’s that the global economy can sustain itself and decouple itself from the value that oil provides to the economy with the right fiscal controls.

[1] http://www.reuters.com/article/us-global-oil-idUSKCN0WU01Y

[2] http://www.bloomberg.com/news/articles/2016-03-29/u-s-index-futures-little-changed-as-investors-look-to-yellen