FINANCING the UNIVERSITY --

PART 11

by Charles Schwartz, Professor

Emeritus, University of California, Berkeley

schwartz@physics.berkeley.edu

April 25, 2007

>>This series is available on the internet at

http://ocf.berkeley.edu/~schwrtz

WHERE THE MONEY GOES – Lesson #1

Some numbers, a

picture and detailed explanations are provided to illuminate the most

misleading habit of research universities in answering the simple

question: What is the cost of Education?

The

University’s Accounting System

This University has a well-established

accounting system that reports how our money is spent. The annual

report on Expenditures of Current Funds, for the fiscal year 2005-06,

gives a total of over $14 Billion (not counting the DOE Laboratories)

and this is detailed in Table 1 below in terms of ten standard

categories.

Table 1: UC Operating Expenses by

Function (2005-06)

Uniform Classification Category

|

Expenditure ($ Millions)

|

Instruction

|

3,212

|

Research

|

3,036

|

Public Service

|

401

|

Academic Support

|

1,139

|

Medical Centers

|

3,675

|

Student Services

|

470

|

Institutional Support

|

764

|

Operation & Maintenance of

Plant

|

452

|

Student Financial Aid

|

364

|

Auxiliary Enterprises

|

720

|

Source: Annual Financial

Report, inside front cover

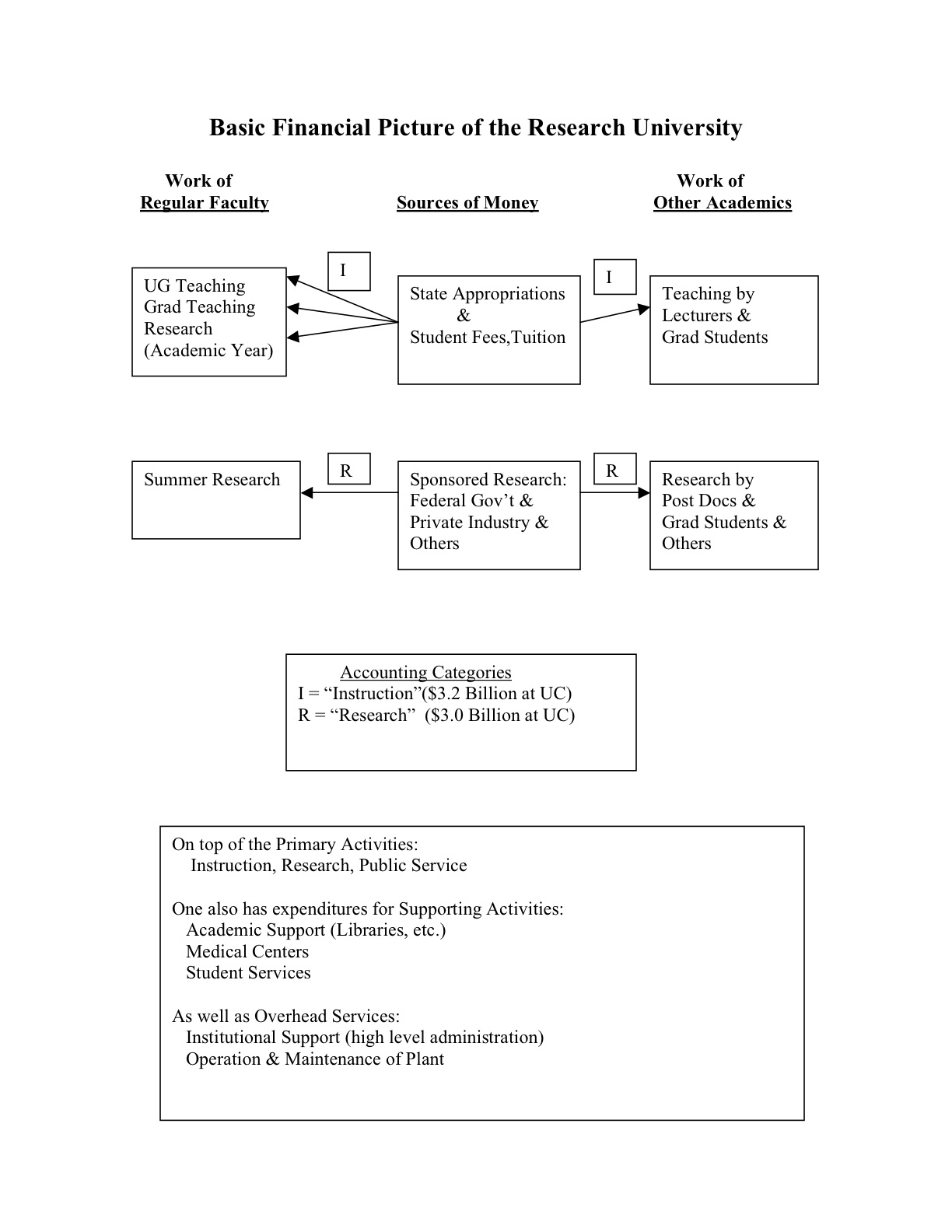

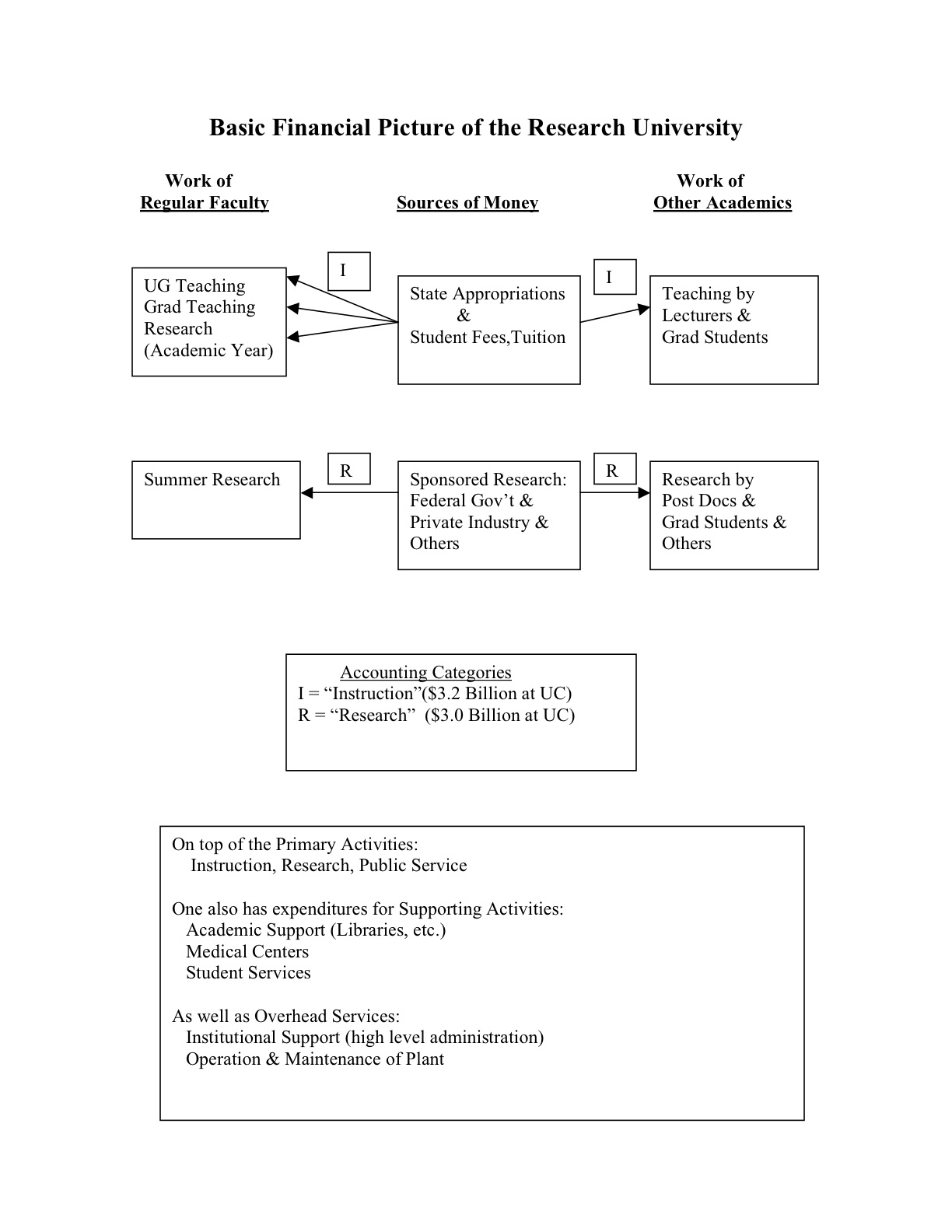

It is most important to understand what these

accounting categories mean. The University has a three-fold

mission: Teaching, Research, and Public Service. However, it

would be a serious mistake to believe that the three top accounting

categories, listed above, accurately reflect spending for each of those

three missions. To understand the basic funding arrangements of

UC (or any research university), refer to the picture on the following

page. This illustrates the basic fact that the accounting

category called “Instruction” covers the full expenditure for salaries

and benefits of the faculty throughout the academic year; thus it

supports their work in Research (and Public Service) as well as their

work in Teaching.

To formalize this picture, let me quote from

the official Accounting Manual, which gives the definitions of these

categories.

INSTRUCTION: This category

includes expenditures for …

• academic instruction…

• departmental research and public service that are not separately

budgeted; …

What is Departmental Research?

A typical professor (like me) at a research

university (like UC Berkeley) is hired as a member of the faculty of a

specific academic department (like Physics). I am paid an annual salary

for all my University work during the academic year (9 months): this

work includes teaching, research, public service - and also university

service (e.g., campus committees) and professional service (e.g., peer

review of papers for journals in my field of expertise). This total

salary payment (plus benefits) is recorded by the university as an

expenditure of Current Funds for Instruction. Also included in

this cost category are expenditures in my department for support staff,

supplies and equipment that are provided in assisting me effectively to

perform those duties. (In budget language, this whole package is called

“the I&R budget.”)

What happens during the summer months?

Nothing, as far as the accounting of Instructional Expenditures is

concerned. If I happen to have an external research grant (“Sponsored

Research”), then I can draw extra salary from that source for my

research activity during 2 or 3 months of the summer, when I am free of

any teaching duties; that expenditure will be recorded under the

accounting category “Research.”

Is there any difference between the research

work I do during the academic year (Departmental Research, paid for

under the accounting rubric of “Instruction”) and the research work I

do during the summer (paid for under the accounting rubric of

“Research”)? No. I just have more time to devote to my research

during the summer, without the distraction of teaching classes.

The external research grant which I have (as a

Principal Investigator) does pay out significant money for my research

program during the academic year. That money may go to paying

post-doctoral researchers, graduate students, research technicians, and

secretarial staff that I hire to assist me in my research program. It

may also go for the purchase of research equipment, pay for ancillary

research costs, travel to conferences, etc. It does not pay for any

part of my salary during the academic year. (I am designated as “100%

I&R faculty.”)

With this understanding now in hand, please go

back and look at the picture presented earlier and see how things fit

together.

(I have left out the whole subject of the “overhead” money, which the

University collects on any externally sponsored research. This is

an interesting subject to discuss, but it is not relevant to our

present focus.)

The picture and explanations I have presented

above are not unique to UC. This accounting scheme is pervasive, being

promulgated by the long established organization NACUBO – National

Association of College and University Business Officers. The good thing

that such industry associations do is to establish a uniform system of

accounting and reporting.

What

Is the Cost of Education?

If you look in the annual Budget for Current

Operations produced by the University of California Office of the

President (UCOP) you can find the statement that the Average Cost of

Education at UC amounts to $17,030 per student for the year 2006-07.

[See page 71 or page 99 or page 236 of the Budget issued November

2006.] It also says there that UC students “currently pay 30% of

the cost of their education” referring to the fees we now charge them.

What does this mean? I expect that most

people reading this will believe that this cost figure refers to the

cost of undergraduate education; but that is not correct. Based

upon my earlier correspondence with UC officials, it is established

that this figure ($17,030 per student) covers that whole bundle of

expenditures described earlier as counted under the accounting category

“Instruction.” In other words, this is the university’s total

expenditure for undergraduate education plus graduate education plus

departmental research (along with their supporting and overhead

expenses), divided by the total number of students. Yet they call it

the Cost of Education.

Stanford University is even more blatant in

providing this sort of misleading information. Their recent press

release announced that undergraduate tuition will be going up to

$34,800 next year but, they claim, “tuition covers only about 60

percent of the costs of educating an undergraduate.” I have had

an interesting correspondence about this with officials at Stanford and

they have explained that they do their calculation following a

methodology established by NACUBO.

Let’s look into this.

The

NACUBO Study

The study, issued in 2002, is titled,

“Explaining College Costs – NACUBO’s Methodology for Identifying the

Costs of Delivering Undergraduate Education” and it may be found

at http://www.nacubo.org/x376.xml The

Preface of that 52-page document explains its origins as follows.

In 1998, the National Commission on the

Cost of Higher Education issued a report calling on the nation’s

colleges and universities to increase their public accountability and

to develop better consumer information about costs and prices. In

response, the staff of the National Association of College and

University Business Officers began to consider how the association

might help its member institutions meet the commission’s charge. The

result is NACUBO’s Cost of College Project, which is the subject of

this report.

The goal of the project was to create a uniform methodology that any

college or university in the nation could use to explain and present

how much it costs to provide one year of undergraduate education and

related services. Most observers might think this would be a relatively

simple task. However, the fact that it had never before been done was

one indicator of its difficulty. The complexity and diversity of

American higher education had thwarted previous efforts to devise a

cost reporting system that could be acceptable to professional

economists, never mind a methodology that was amenable to public use by

every institution.

In summary, the prescription they came up with

for calculating the Cost of Undergraduate Education is as follows. Take

the full expenditure for Instruction and for Student Services; add an

allocation of overhead for general administration, facilities

management and depreciation of plant and equipment; divide this total

cost by the number of students enrolled, perhaps with some extra

weighting given to graduate students.

I think that is a reasonable methodology for

colleges and universities whose only mission is undergraduate

education, plus, perhaps, a modest program for graduate students.

However, when one considers the realities of a research university,

then we must consider the question of how to account for Departmental

Research. Here is what NACUBO concluded about this (page 27).

Departmental Research.

Several alternative proposals were considered, but NACUBO concluded

that all departmental research costs should remain within instruction

and student services. Departmental research is vital and has a direct

impact on the value and quality of instruction provided to students. ….

This is strange logic. In its

introductory sections, their report says (page 9), “NACUBO never

intended its Cost of College Project to address issues of value or

quality…” yet here we see they depend on a claim of the “value and

quality” this research activity gives to instruction. Even if one

were to admit that faculty research does contribute some significant

value to undergraduate instruction (and this is a contentious claim),

NACUBO goes way overboard in saying that the entire expenditure for Departmental

Research should be charged to the cost of education. I consider

this distortion of reality to deserve the name of fraud.

How

to Do it Honestly

What then would be an honest way to calculate

the Cost of Education? Look again at the financial picture given

earlier and note that box, in the upper left corner, that shows the

components of “Work of Regular Faculty,” which is counted as

Instructional expenditure. All one needs to do is to disaggregate

this bundle of work and their associated portions of that cost

component. Is there an objective way to make such a quantitative

separation between faculty’s teaching work and their research work?

This is a type of problem that occurs

frequently in economics and business management. Cost Accounting

is a well-developed subject; and the particular method of Activity

Based Costing (ABC) is the standard answer to our question. You don’t

need an advanced degree in Business Economics to see that if you know

how much of their work time is spent, on average, at these different

functions, then you can assign appropriate portions of the total

cost. And, indeed, there exists data on this very question for

the UC faculty.

From 1978 through 1984 the University of

California conducted a series of Faculty Time-Use Studies and this data

provides the most authoritative answer to the question of how faculty

at a leading research university spend their time. Roughly

summarized: about half of the professors’ work time, on average during

the academic year, is devoted to teaching and half devoted to research

and professional service. The teaching activity is again divided,

about equally, between undergraduate and graduate instruction.

With this key data in hand, I have calculated

that the actual expenditure for undergraduate education at UC averages

about $7,000 per student per year. That is quite a lot different

from the $17,030 figure published by UCOP. It means that

undergraduate students (and their parents) are now required to pay fees

that amount to a full 100% of the actual cost of the education we

provide for them. This conclusion has all sorts of implications

for public policy – at the University, at the State level, and at the

Federal level.

For Stanford University, I estimate that what

they actually spend on undergraduate education is about half of what

they charge in tuition.

For the details of this calculation see “The

Cost of Undergraduate Education at a Research

University,” which is posted on my web site; and for extension of this

result

to other research universities, both public and private, see Part II of

that same paper.

If officials of this and other research

universities disagree with my results, then they must provide their own

calculations – but let them be honest and not distorted by the fiction

about departmental research that NACUBO has promulgated.