Financing the

University –

Part 22

Charles Schwartz, Professor Emeritus,

UC

Berkeley, February 27, 2013

Schwartz@physics.berkeley.edu http://ocf.berkeley.edu/~schwrtz

COST ACCOUNTING at

a RESEARCH

UNIVERSITY

My

previous study on this topic, with the title, “The Cost of

Undergraduate

Education at the University of California – Improved Calculation”, was

posted

in late 2007 at http://ocf.berkeley.edu/~schwrtz/recost.html.

It

concluded

that

the current level of mandatory fees for resident

undergraduate students is very close to 100% of the University’s actual

expenditure for undergraduate education, averaged per student. In

contrast, University officials said that student fees covered 30% of

the cost

of education.

New

results reported here, for the year 2011-12, show University

expenditures of:

$1.296

Billion for Undergraduate Education = $6,910 average cost per student;

and

$2.117

Billion for Faculty Research (unsponsored) and related Graduate

Programs.

The mandatory fee level for resident undergraduate students was $13,181, which is nearly twice what it cost the University to provide their education. In this paper, I shall review the method used before, then go through the steps with the latest input data. At the end is a critical discussion of the implications of these financial facts, including an indictment of the University leadership for their dishonesty.

I. Introduction

The University of

California (UC) is engaged in many activities, with an annual operating

budget

of around $23 Billion, funded by a variety of sources. Table 1, below,

displays

a standard breakdown of UC’s Operating Expenses by Function.

Table 1. UC Operating Expenses by Function for

FY 2012 ( in $Millions)

|

Uniform Classification Category |

Nominal Exp’s |

Actual Exp’s |

|

Instruction (I) |

5,146 |

4,571 |

|

Research (R) |

4,325 |

4,195 |

|

Public Service (PS) |

591 |

545 |

|

Academic Support (AS) - including Libraries |

1,910 |

1,812 |

|

Student Services (SS) |

780 |

710 |

|

Institutional Support (IS) |

1,118 |

775 |

|

Operation and Maintenance of Plant (OMP) |

587 |

540 |

|

Student Financial Aid (SFA) |

601 |

601 |

|

Medical Centers (MC) |

6,691 |

6,366 |

|

Auxiliary Enterprises (AE) |

1,089 |

1,019 |

|

Depreciation and Amortization (DA) |

1,477 |

|

|

Department of Energy Laboratories (DOE) |

1,008 |

1,008 |

|

Total

|

25,323 |

22, 142 |

Notes to Table 1. The Nominal Expenditures

can be

found in the UC Annual Financial Report 2011-12, page 8, under

“Operating

Expenses by Function.” The Actual Expenditures differ by not adding the

“Retiree Health Benefit and Pension Accrual,” which are not real

expenditures

but a required bookkeeping of future obligations (totaling $2,449

Million), and

by not subtracting the “Expense Capitalized” items (totaling $748

Million),

which cover just about half of the Depreciation and Amortization amount

seen in

the first column. One may find both the Nominal and the Actual

Expenditures

data (without the full DA) in the UC Campus Financial Schedules (CFS),

Schedule

12-H. All of those official accounting reports are available at http://www.ucop.edu/financial-accounting/financial-reports/index.html

The first question we

want to address is: How well (or poorly) does this classification

scheme tell

about the expenditures in terms of familiar missions of the University

and its

several clienteles. The question, “Who pays for what?” will come later;

and I

am especially interested at getting down to details about student fees

and

state appropriations.

Some items seen in

Table 1 really mean what they say, in a fully exclusive way

(financially speaking).

Thus, the DOE laboratories are fully funded by the U.S. Department of

Energy to

perform certain functions and all that money is spent for the

laboratories. One may note that

there is substantial interaction between Lawrence Berkeley National

Laboratory

and the UC Berkeley campus: some 200 UCB faculty members hold joint

appointments at the lab and many of their graduate students also work

on the

lab payroll. This “synergy” is beneficial to both the lab and the

campus; but

there is no question about their distinctly separate financial accounts.

Another clean example

is the Auxiliary Enterprises: dormitories, dining halls, parking lots,

etc. on

each of UC’s ten campuses. These are described as “self-supporting”

since they

are paid for by fees charged directly to the individuals who use those

facilities. (There are some debates about the finances of

Intercollegiate

Athletics, which comes under this category; but I will not pursue that

issue

here.)

The Medical Centers

(sometimes called Teaching Hospitals) are also described as

self-supporting

business enterprises, although there is substantial flow of personnel

and funds

between the hospitals and clinics and the Medical Schools on the

campuses. It

is customary for the official UC budget to have distinct sections about

Health

Sciences (HS) Instruction and General Campus (GC) Instruction. This

separateness, between the HS and GC sectors, has been memorably

identified by

the UC Office of the President (UCOP) in responding to suggestions for

meeting

the University’s budget crises: “A federal grant for laser beam

research

can’t be used to fund a deficit in the English Department. A payment

for a

surgery in a UC hospital can’t be redirected to fund graduate students.” [UCOP, “The UC Budget: Myths &

Facts,” April

2009].

The category of

Research expenditures, shown in Table 1, covers work sponsored by

external

agencies and some internal budget funds dedicated for specific research

projects; 87% of those funds are Restricted, meaning that they cannot

legally

be used for purposes other than originally intended.

It turns out that the

most complex category is Instruction; and so I start by taking this

apart into

several specific sub-categories.

To do this, I rely on the extensive set of accounting reports

called “UC

Campus Financial Schedules” (CFS), which may be found at http://www.ucop.edu/financial-accounting/financial-reports/index.html. This shows us expenditures, campus by

campus, and even department by department, where each of the categories

shown

in Table 1 are broken down into further details.

II. Review of the Method

That expenditure

category called “Instruction” contains several things that one would

want to

separate out if the object of your study is to find out how much the

institution actually spends for undergraduate instruction. It includes

all

salaries and benefits paid out to all regular faculty members

throughout the

academic year, plus the cost of supporting staff in the academic

departments. This bundle of costs

used to be called the I&R (for “Instruction & Research")

budget.

This

accounting category called “Instruction” even includes an enormous

amount of

money taken in by the clinical practice of medicine and paid out to the

faculty

at the Medical Schools. So, our

first step will be to put aside all the expenditures for all the Health

Sciences (which do involve graduate student programs, but not

undergraduate

programs); and then we also put aside the largest of the other graduate

Professional Schools – those in Law and Business/Management.

This leaves us

with the wide array of academic departments that have both

undergraduate

programs and graduate programs. But there is still one major problem:

the

accounting habits of research universities obscure the fact that

professors are

hired to perform research as well as teaching and simply record the

totality of

their academic year salaries as expenditures for “Instruction.” (The

phrase

“Departmental Research” is used to cover that deceptive practice.)

My approach,

following the classical method called Activity Based Costing, relies on

a

Faculty Time Use Survey conducted by UC a number of years ago. As described in detail in the previous

paper, that analysis leads to the result that 21% of professors’ work

time, on

average, may be fairly allocated to the mission of undergraduate

instruction;

the rest is apportioned to research, graduate instruction, and some

professional service activities (which are mostly tied to the research

endeavor.)

In what follows, I

will first dissect the expenditures for Instruction (to get the direct

cost of

undergraduate instruction), then dissect the category Academic Support

and add

in Student Services as supporting costs for undergraduate education;

and then

finally I add in overhead costs from IS and OMP. For more details on

these

calculational procedures, see the previous paper from 2007.

III. The Updated Calculation

Instruction.

The total UC expenditure for Instruction,

in fiscal year 2011-12, is $4,571

Million. From this we subtract: $298 Million for University Extension

and

Summer Session; $1,853 Million for Health Sciences; $301 Million for

Schools of

Law and Business/Management; and $144 Million for other expenditures of

Restricted funds. This leaves us

with an Adjusted Cost for Instruction of $1,975 Million.

To get the

Undergraduate Instruction part of this we first separate out the

amounts spent

on Lecturers (1857 FTE @$75,000, 81% for undergraduates) and Graduate

Student

Instructors ($156 Million, 87% for undergraduates). The remainder is

then

multiplied by the factor 0.21 and we arrive at,

Academic

Support.

Expenditures for Academic Support:

Libraries ($260 Million - $32 Million Restricted); Other Academic

Support

($1,552 Million - $1,018 Million for Health Sciences, $56 Million for

Law and Business and $40 Million Restricted = Adjusted $438 Million).

Allotting

½ of the former and ¼ of the latter to undergraduates,

Student

Services. From the total expenditure for

Student

Services ($710 million), I subtract the $231 Million spent for Student

Health

Services (paid for by other fees) and another $45 Million of Restricted

funds,

giving us,

Overhead. Total

expenditures

for

Institutional

Support

plus

Operation

and Maintenance of Plant amount to $775 Million + $540

Million =

$1,315 Million. If I spread this

cost evenly over all UC expenditures, I get an effective overhead rate

of

1315/22142 = 6%. In the previous

calculation, I reduced the denominator of this fraction by the amount

spent by

the Medical Centers, assuming that they paid for their own “overhead”

services:

that gives an effective overhead rate of 1315/(22142 – 6366) = 8%. I am

not

sure which method is correct, so I’ll use the figure 7%.

To this I might add

the capital cost, estimated from the reported amount of Depreciation

and

Amortization, $1,477 Million, less the amount already counted by

keeping in Expense

Capitalized, $748 Million. If I

allocate this cost uniformly over all expense categories, it amounts to

another

3% to 5% overhead.

IV. Final Numerical Cost Results for FY

2011-12

Adding the

contributions from Instruction, Academic Support and Student Services

(79% for

undergraduates), then adding 11% of that sum for overhead, we arrive at,

In addition, we can

do something that was simply ignored in the previous study: identify

the

residual portions of the costs from the I&R bundle. That would

represent

the total UC cost for faculty research (unsponsored) plus graduate

student

programs that are closely tied to that research mission.

If we combine these

two separate costs and add in the costs noted earlier for Law Schools

and

Business Schools (with appropriate overhead), we come to a total GC

cost of

$3,809 Million. Dividing this by the total GC enrollment for 2011-12 we

get an

average per student cost for the whole GC I&R bundle at about

$17,100 per

student. This figure is very close to what UCOP published as the

Average

Per-Student Cost of Education for 2011-12, about $17,400. This close

agreement

is reassuring. However, we note how misleading UC’s number can be - exaggerated

by

a

factor

of

three -

if people think that their “Cost of Education”

represents the cost for undergraduate education, rather than the cost

of that

much bigger bundle of activities.

Note. In these calculation, neither UC nor I

include any expenditure of student financial aid as a part of the cost

of

education. The data for SFA shown in Table 1 represent funds provided

by

external agencies (81% from the Federal government); and most of those

are

Restricted funds and thus represent no operating cost to UC. A closer

look at

fees and financial aid comes next.

V.

Per-Student Costs compared to Student Fees

On the basis of their

Education cost figure, UCOP says that student fees (net of financial

aid) now

cover 49% of the cost of education.

Dividing my Undergraduate Education cost figure by the number of

undergraduates enrolled (187,566), we find,

Since the

average

mandatory fees for resident undergraduate students in 2011-12 was

$13,181, I

would say that resident undergrads were being charged 191% of the

average

actual cost for UC to provide their education!

However, this is not a correct comparison because UC uses net

student

fees (after deducting a portion for financial aid) and I use gross

student fee

levels. One can (roughly) convert from gross to net by using a factor

2/3, and

this gives us a choice of two fair comparisons:

UCOP says

Student Fees

(net) cover 49% of their cost and I say it is 127%.

UCOP says

Student Fees

(gross) cover 74% of their cost and I say it is 191%.

Either way, there is

a huge discrepancy, due to our different methods for calculating the

Cost of

(Undergraduate) Education: my method is reasoned and fair (while

details are

subject to debate) while UC’s method is manifestly false and misleading.

Another way of

putting this result: Undergraduate students now pay (even more than)

the full

cost for undergraduate education provided by UC. The State of

California now

pays for no part of undergraduate education at UC and it pays for only

a

portion of the cost of faculty (unsponsored) research and related

graduate

programs.

VI. Discussion of the Implications

of these

Results

A few years ago I

filed a formal whistleblower complaint with the University’s Office of

Ethics,

Compliance and Audit Services, alleging that top UC executives were

issuing

false and misleading information – specifically on this question of the

cost of

undergraduate education – and that this constituted fraud under laws

prohibiting improper governmental activity. In response, I was told

that their

method of calculating the per-student cost of education is promulgated

by the

National Association of College and University Business Officers

(NACUBO) and

has been endorsed by the higher education community.

I charge that the

practice of research universities hiding the true cost of faculty

research

under the rubric of undergraduate instruction is false and misleading;

and the

official response is that everyone else does it, so therefore it is ok.

That organization

NACUBO convened a special committee some years ago to decide how best

to

calculate the institutional Cost of Undergraduate Instruction and

communicate

that to the public. Their 2002 report contains an explicit discussion

of this

very issue: “NACUBO concluded that all departmental research costs

should

remain within instruction.” That accounting rule makes sense at any

college

where the sole mission is undergraduate education, but I challenge

anyone to

justify that for a research university today.

There was a time when

that bundling of costs could be justified as causing no harm. When the

state

paid for the entire cost of the core budget (covering I&R), one

could say

that both teaching and research were seen as “public goods” and paid

for by

public money; so there was no harm in bundling them all together. Over the last two decades, however,

there has been a fundamental shift in how our public universities are

funded:

there has been marked decrease in state funding and marked increase in

student

fees (tuition) – most of which is paid by undergraduate students. This

shift

has been accepted with a change in philosophy that says undergraduate

education

is a “private good” since it leads to economic benefits for those

students.

That shift ought to call forth a change in the accounting habits; but

no such

thing has occurred. Isn’t academic research still a “public good”?

Consider this

statement from the head of the Howard Jarvis Taxpayers Association,

published

July 5, 2010: "As California faces an unprecedented budget crisis,

students at California colleges have been asked to pay a greater share

of the

total cost of their education, most of which is still borne by

taxpayers.

...[T]axpayers pay 60-70% of the cost of ... UC students' education,

without

even counting financial aid." They got their 60-70% number from UC

officials saying that student fees covered 30-40% of the cost of

education.

This is evidence of the harm caused by that bad accounting habit.

This is not just a

California problem. That bad old accounting habit of hiding the cost of

core

research, and thus misstating the true cost of undergraduate education,

infects

every research university, both public and private, throughout the

country. It

is a huge failure of leadership in higher education not to acknowledge

and

correct this problem.

The most obvious harm

is that it invites continuing escalation of tuition and the

consequences in

terms of hindered access and mountainous student debt.

One can also see sad distortions in the

way that our leaders address their financial problems.

Coming out of the

year-long study by the UC Commission on the Future was a set of

recommendations

to decrease the cost of undergraduate education; they never even

mentioned that

the cost of research was the larger problem.

We have heard lots

about the call for increased online education as a way to decrease the

cost of

undergraduate instruction; but that is not UC’s main cost problem.

We have heard a lot

about increasing enrollment of nonresident undergraduate students

(which brings

in more money). This tick’s off California taxpayers who feel that

their own

children’s access to UC is being closed. UC officials reply that they

only

admit nonresidents to fill “unfunded” seats. But since every

undergraduate

student now pays more in tuition than it costs UC to provide them a

seat, there

are no “unfunded” seats.

So this is a big

mess. Who is responsible? At the

top of any great university’s governance there is a Board of

Regents/Trustees/Governors. It is

likely that many of those people are just incompetent – although the

reason

those people [usually big successful business magnates] are there is to

provide

sensible business guidance to the academic world. It is more fitting to

blame

the top level of academic administrators – Presidents and

Vice-Presidents,

Chancellors and most Vice-Chancellors – who know very well about the

lies and

distortions and the funny-money games that are being exposed here.

_

_ _ _ _

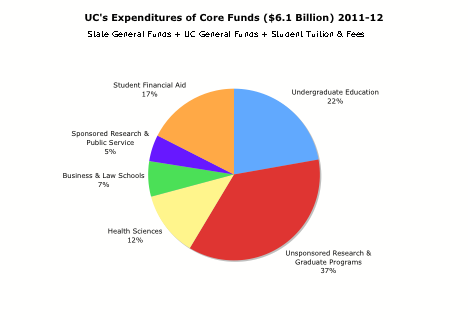

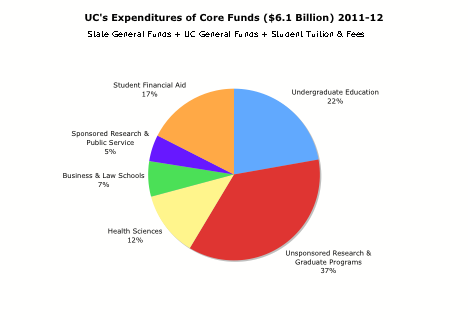

In recent years UCOP

has promoted the concept of “Core Funds” in its budget documents. These are defined as revenues from

State General Funds (37%; state appropriations) and UC General Funds

(13%:

mostly Nonresident Supplemental Tuition + a portion of Federal Indirect

Cost

Recovery) and Student Tuition and Fees (50%: gross

revenues

from

Tuition

+

Student

Services Fees +

Professional Degree Supplemental Tuition).

This

is

from

page

S-15

of

the

latest Regents’ Budget:

the University’s core

instructional and research

programs still rely primarily on the combination of State funds and

tuition and

fees. These core funds remain the foundation of UC’s academic program.

Fully

97% of ladder-rank and equivalent faculty, for example, are paid on

core funds.

Using

the

methods

described

in

this

paper,

I have constructed the following (approximate)

picture

of how those Core Funds were spent in FY 2011-12. This

sort

of

information

has

never

been published before.

INVITATION

I sent a draft of this paper to a number of colleagues, asking for their comments and criticisms. The responses led me to decide that a follow-up paper will be needed to explore a number of important issues. So, Dear Reader, since you have read this far, please accept my invitation to send me your own questions and challenges.