Project Summary

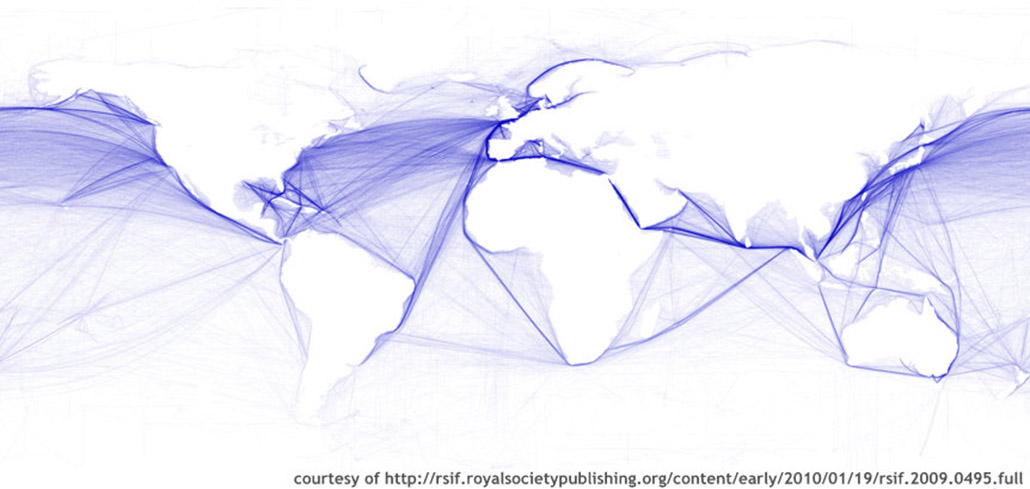

China’s accession to the WTO has profound implications for East Asian trade relations, and many of the more established regional agreements (ASEAN, etc.) are being re-examined in light of this initiative by a prominent trading partner. China has already established new standards for sustained growth and dynamic resource allocation by a large economy, and further Chinese domestic and external liberalization will redefine trade relations in ways that are only beginning to be understood.

Initial reactions of regional partners, who perceive China as a strong export competitor and magnet for FDI, have been somewhat defensive. These sentiments could undermine multilateralism and retard the dramatic historical progress of regional trade and economic growth. Our research reveals a more complex picture of China’s emergence, however, one that presents as many opportunities as threats to East Asian policy makers.

Because of its sheer size and stage of development, China will play two roles in the region with unusual prominence. First, it will stiffen regional export competition in a broad spectrum of products. Because it is still in the early stages of an export-oriented growth strategy, this aspect of China’s economy has attracted the most attention and contributed to a threatening image. Secondly, China’s long term growth trajectory will make it a prominent importer in East Asia. Because China’s internal economy is still emerging, this aspect has attracted less attention. Thus China interposes itself between the rest of East Asia and the Rest of the World as both an export competitor and an emerging importer but, because of its early stage of development, regional perceptions have been biased. More attention is currently focused on the export (threat) side and the import (opportunity) side is underestimated.

This paper presents an empirical analysis of China’s regional economic emergence, intended to improve longer term visibility for policy makers, helping overcome the threat-bias and better identify the horizon of opportunity for other East Asian economies. A multi-country dynamic forecasting model is used to elucidate regional and domestic adjustments that will ensue from China’s WTO accession over the next two decades. Generally speaking, Chinese growth is found to produce a variety of dramatic adjustments in East Asia, but that the benefits for every regional partner can outweigh the costs if multilateral trade policies are accommodating.

Primarily because of its size, China appears to be in a unique position to “go it alone” on the path to globalization, i.e. most of its own benefits from multilateralism can be captured by unilateral liberalization. At the same time, a large part of the aggregate regional benefits from growth arise from China’s unilateral initiative. For example, we predict that, by 2020, China will develop a large structural trade surplus with Western OECD economies, but a structural deficit of about equal magnitude with East Asia as a whole. This surplus “transfer effect” implies that the region can continue leveraging external demand to meet its growth objectives, but the composition of this growth will depend upon bilateral balances.

Thus the future benefits and costs for individual East Asian economies will depend upon the extent to which they adapt to more open multilateralism, regionally or globally joining efforts to reduce barriers to trade. Only in this way can they avoid crowding out from their established export markets and fully capture new export opportunities. The latter are represented mainly by China, directly in terms of its burgeoning domestic demand, and indirectly as it absorbs intermediate goods to meet export demand from the Rest of the World.

As an example of this, we forecast the consequences of a widely discussed regional trade arrangement, AFTA plus China. By enlisting China in its regional liberalization, the ASEAN economies leverage China’s growth to their advantage. AFTA alone might be beneficial, but inclusion of China provides essential economic diversity, scale opportunities, and indirect market access via Chinese absorption for export production. The result of AFTA plus China is accelerated ASEAN trade expansion, sometimes at the expense of other East Asian economies.

For one country in particular, the response to China’s WTO initiative will be decisive. Our forecasts indicate that, in the absence of new protectionism, China will be Japan’s largest trading partner by 2020, exceeding all other bilateral sources of imports and export markets. This represents an unprecedented opportunity for the Japanese economy, but to realize it will require a fundamental reorientation of industrial policy, away from traditional (western OECD) export destinations and toward the world’s fastest growing consumer society.

Most Recent Entries

California and China: Leadership for a Low Carbon Future

Roadmap on the Prospects for GMS National Scaling and GMS Regional Coordination of Agrifood Traceability Schemes