by Charles Schwartz, Professor Emeritus, University

of California,

Berkeley

schwartz@physics.berkeley.edu

April 21,

2004

>> This series is available on the Internet at

http://ocf.berkeley.edu/~schwrtz

New Data Refute UC’s Investment

Experts

A new analysis of comparative data on public pension

funds shows how remarkably successful the UCRP (University of

California Retirement Plan) investment program had been over the decade

before Wilshire Associates was hired to direct the regents’

investments. UC, with its unusual style of internal investment

management, has a history of fiscal strength (ratio of assets to

liability) which far surpasses all other statewide pension systems

throughout the nation. These facts serve to refute two different types

of false and misleading claims that have been used by UC’s new

investment experts to justify the recent outsourcing (privatization) of

the funds’ management.

A UC reader recently sent me this inquiry :

As you have looked into all these issues closely, I ask how well do you feel our pension fund [has done and may do] compared to similar entities, e.g. New York State, State of California - I think different from University system - other large public Universities....

I can't make any predictions about the future. I have some comparative data about the recent past. UC had done very well (perhaps outstandingly well, I have not completed my analysis of this) compared to other large public pension funds up to 2000, when there was a change of leadership and also a change in the market. Since then, all have gone down; UC may still rank very well but I am not yet sure whether this is all due to the previously amassed surplus or whether the leadership since 2000 deserves some credit.

A comparison of UCRP’s financial status

with that of other state pension funds is possible by means of data

which has been collected and published over the years by Wilshire

Associates. I first became aware of that series of reports last year

and mentioned it briefly in paper #18 of this series. Just recently,

however, I have been able to collect the full set of Wilshire’s data

and carry out the analysis necessary for a proper comparison. (Each

Wilshire report mixes data from several different years in calculating

a ranking; I had to separate their data to make same-year comparisons.)

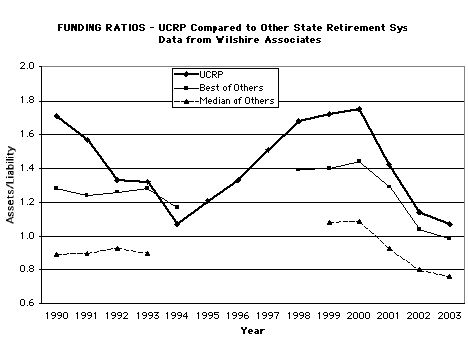

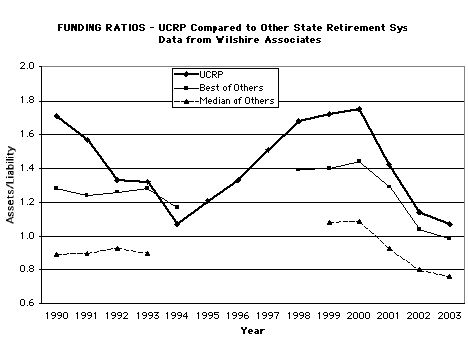

The full set of results is shown in the graph

of Figure 1. Wilshire ranks the individual pension funds by their

Funding Ratio, which is calculated as the ratio of Assets (at Market

Value) to Liability (Actuarial Accrued Liability) as reported by each

of the funds; and I follow their methodology. A pension plan with a

Funding Ratio of less than 1.00 is said to be “underfunded.”

The graph below shows that UCRP has always

been far above the Median of the comparison group and even well above

the Best of all members of the comparison group, with only one

exception (in 1994). This demonstrates, very dramatically, UC’s

long-standing superiority in the financial management of its retirement

plan.

Source of this Data: “2004 Wilshire Report on State Retirement

Systems”

and earlier issues. The nine reports in this series, dated from 1990 to

2004, define Funding Ratio as (Assets at Market Value) divided by

(Actuarial Accrued Liability). The data in each Wilshire Report are a

mix of valuations from several different years and so I have had to

unscramble this data collection to make comparisons within each

calendar year. The size of the comparison group (“Others”) for each

year varies from 4 (in 1994) to 28 (in 1999) to 105 (in 2001); these

reports from Wilshire leave a big gap in data for the years 1994-1998.

I am grateful to Julia Bonafede of Wilshire Associates for sending me

copies of their past reports; the most recent ones may be found on the

internet.

Some additional facts lead us to believe that

UCRP’s superior history, displayed in the above graph, is actually understated.

• Since 1990, UC has suspended all contributions to the pension fund from both employer and employees, which means that its assets are reduced, compared to other funds that did collect such payments. I do not know how to estimate the quantitative effect this has on the overall comparison with other pension funds. However, I note that CalPERS (their PERF fund) received contributions from members (employees) amounting to a total of $14.1 billion and from employers amounting to $13.4 billion over the period 1991-2001; and this combined revenue accounts for about 20% of their current total assets. (If you plot CalPERS’ funding ratios on the graph above, they come out above the Median of Others.)

• Another technical detail is the “interest rate assumption” which

is important in the calculation of Actuarial Accrued Liability for any

pension fund. UCRP has used a conservative (7.5%) value for this,

compared to a higher (8.0%) average of the other funds. This means that

UCRP’s calculated Liability is higher, and its Funding Ratio is

therefore lowered, in the above comparisons.

In Wilshire’s “Investment Strategy Study,”

prepared for the UC Regents, March 16, 2000, we find (page 4) the

following acknowledgment of UCRP’s fiscal strength:

Experts commonly look at the ratio of assets-to-liabilities as a measure of pension plan fiscal strength. The [UC] Plan’s ratio of 1.71 ranks near the top as compared with other large defined benefit pension plans. ... The Plan’s 1.71 funding ratio also far exceeds ratios reported by corporate and governmental retirement plans. The average funding ratio is 1.14 for corporate plans and 0.94 for governmental plans.Strangely, however, this fact was overridden in later evaluations from Wilshire. Our new accumulation of data, establishing UCRP’s uniquely superior financial history, may be used to refute two sets of phony arguments that have been used by the regents and their hired experts to justify the recent outsourcing of UCRP investment management.

When the regents’ Committee on Investments

met on October 29, 2002 to consider the proposal that UC’s equity

investment staff be fired and the funds given over to outside

investment managers, they were given the following argument (from page

4 of the transcript of that originally closed session):

TREASURER RUSS: ... We’re an outlier in this area. We’re managing ...And when this same issue came before the whole Board of Regents on November 13 (another closed meeting), we find the following on page 4 of the official Minutes:

REGENT PARSKY: What does an outlier mean?

TREASURER RUSS: We’re an unusual institution in that we are managing so much money internally. We are actually managing about 74% internally. If you look at - well there, 76%, excuse me, internally versus 24% of our external. That includes the index funds, the private equity, the emerging markets funds that are managed externally. The bonds and the U.S. equity internally managed is the 76%. Other endowments, this data is from Cambridge [Associates], managed 14% internally, 86% externally. There’s a lot of data in the appendix of your package that goes into more detail if you’re interested. And then public pension plans about 34% internal, 66% external. That 34% represents bonds in most cases. ... It’s very unusual.

Regent Preuss ... reported that the most recent meeting of the Committee on Investments had been very long and productive, giving the members an opportunity to look deeply into this area. In the process, it was made clear that the University was the outlier among universities in the country and had apparently suffered as a result.There is no denying that UC’s history of managing most of its investments internally made it quite unusual among public pension funds, which mostly rely on external managers. Was that a bad thing? Did UCRP suffer from that eccentricity? The data presented in Figure 1 say, loud and clear, Hooray for the outlier! But did anyone at those regents’ meetings ask about this? Did any of the knowledgeable experts present mention UCRP’s sterling history? Not one peep, as far as we can see.

Phony Argument Two: The Bull Market Made UC Look

Good

This way of explaining away the excellent

returns accumulated by UCRP during the later 1990’s was expressed in

the March 16, 2000 Investment Strategy Study prepared by Wilshire for

the regents (page 5):

Referring back to the Plan’s envious [sic] level of assets in relation to liabilities, it is worth noting that today’s circumstances were created because a 15 year bull market in stocks and bonds, combined with the Treasurer’s Office management, produced investment returns of 15% annually, double the 7.5% interest rate assumption.Here, at least, Wilshire had the grace to acknowledge some credit due to the UC Treasurer. No such nicety appears in the later argument by Regent Judith Hopkinson, who chaired the Committee on Investments during 2000-2002 and subsequently served on the Regents’ Investment Advisory Committee. The following quote is from the Minutes of the November 13, 2002 closed meeting of the Board.

Regent Hopkinson noted that there is a perception that this fund has performed astronomically well. She explained that it appeared to have performed very well during a period when the equity markets were phenomenal, but that in fact it had underperformed during that period, especially in consideration of its high risk level.The graphs in Figure 1 show that everybody’s pension fund assets went up and down with major cycles of the stock market. But the data also show that UCRP was not just riding along with the herd, we were always way our in front of it! This refutes Hopkinson’s first argument in support of outsourcing.

Overall Assessment

The conclusion I draw, from this new data

and related analyses, is that for many years UCRP enjoyed unparalleled

financial success due to unusually capable investment management.

Credit for that belongs to the former Treasurer, Patricia Small, and

her staff, and perhaps also to the regents who, prior to 2000,

supported her investment approach. If anyone has a different

interpretation, I would like to hear it.

My reader asked for future projections, at

which I demurred. But one can say something about what the new order,

introduced by Wilshire Associates at the regents’ request, has

accomplished. In their formal report of March 16, 2000, Wilshire

acknowledged that the primary objective set for them by UC was to

maintain the prodigious surplus which UCRP had accumulated. I have

noted before (see Part 18) that this surplus - Assets minus Liability -

amounted to $18 billion when Wilshire took over in 2000. At last

report, that surplus had shrunk to $2.4 billion; and one finds

officials planning for the University to resume contributions paying

into the pension fund. (See “The Senate Source,” June 2003, published

by UC’s systemwide academic senate.)

Given the state’s dire budget problems, one

can imagine that it is unrealistic to expect funds for UCRP from state

appropriations. Therefore, mandatory employee contributions are most

likely - a difficult imposition given the salary freeze already in

place. Who, if anyone, is to blame? Certainly, Wilshire Associates,

Treasurer Russ and their regent patrons will tell us that it is all due

to the stock market plunge and not any of their fault. However, since

the main purpose of Wilshire’s plan, as adopted by the Board of

Regents, was to preserve the surplus, objectively they have failed, big

time.