by Holly Cheek, Justin Han, Isaac Schmidt, Leonard Yang

September 30, 2019

Due to changing consumer preferences, Mediocre Social Network Apps Incorporated (MSNAI) has struggled for the past few years. MSNAI’s stock price fell to an all time low this past quarter, causing investors to grow skeptical about the profitability of the company going forward.

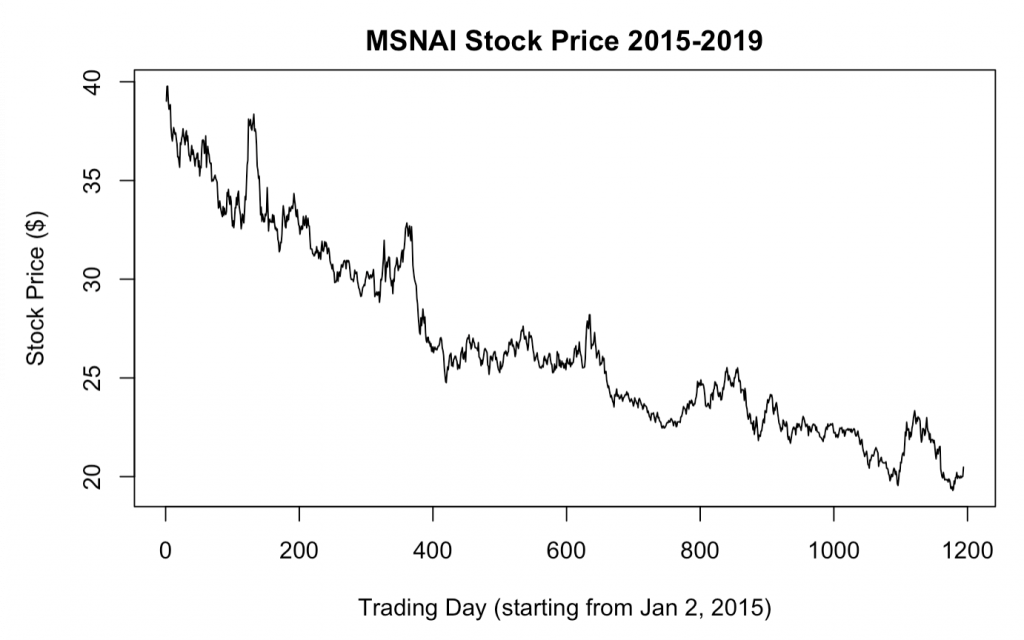

MSNAI’s stock price has shown a downward trend since January 2, 2015. MSNAI closed the first trading day of the year with $39.02 per share. Four years later, MSNAI closed 47.5% lower at $20.48 per share on September 30, 2019.

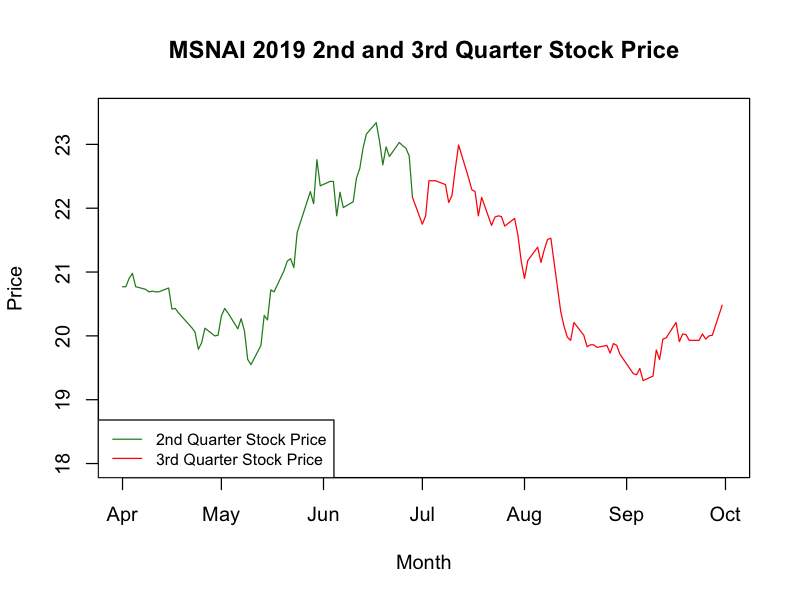

Johnny Appleseed, CEO of MSNAI, has expressed his optimism of the company for this fiscal year. “Our implementation of our state-of-the-art video sharing platform will surprise investors as to what it will do for this company going forward” said Appleseed at the annual Social Network App conference this past January. As predicted, MSNAI’s stock showed optimism during this year’s second quarter, as the company’s stock price made a 13.4% increase.

However, MSNAI’s stock price took a hit in the third quarter. Prices fell 6.2% overall this past quarter–dropping from as high as $23.34 to $19.30, the lowest recorded since its IPO. Investors are skeptical about whether MSNAI can achieve profitability in the future, but Stock Analysts from Jared Fisher Bank™ (JFB) have predicted otherwise.

Stock Analysts have predicted from these initiatives that the stock price is bound to increase for the next ten trading days. Appleseed has been working hard for the last month to drive the video initiatives to adapt MSNAI to changing consumer preferences.

Analysts’ forecasts show a slight uptrend in the MSNAI stock price for the next ten business days. This short-term forecast shows that the closing price will be $20.63 on October 15th, 2019—about a 0.7% increase in its stock price from the last recorded price.

Over the entire 4 years, the stock has been decreasing in a non-linear manner, before appearing to bottom-out as recently. However, the stock doesn’t exactly follow the curved trend. Analysts accounted for these random variations by analyzing the stickiness of the stock prices–they can only deviate so much from day to day. Therefore, even though the stock looks to have flattened out, JFB analysts project a continued increase for the next ten days, as MSNAI’s stock price has been on the rise for the past month. The increase isn’t particularly steep because predicting into the future comes with uncertainty. It is always possible that the stock price could shoot way up, or crash down. Even though these extreme outcomes are unlikely, the model has to “hedge its bets” by accounting for these possibilities.

Given JFB Analysts’ predictions, MSNAI could see a slight uptick to its start of the fourth quarter, which hopefully sets the tone for a positive final quarter of the fiscal year. Appleseed and shareholders are hopeful to see MSNAI reverse its fortunes after four years of falling stock prices.

Absolutely thrilled to see how the Mediocre Social Network has stepped up its game! It’s gone from ‘just another platform’ to a dynamic hub of interaction and engagement. I’ve met so many interesting people here with unique perspectives and talents. What’s been your favorite aspect of this transformation? Let’s chat and share our experiences! #MediocreNoMore

Despite recent struggles, MSNAI may see a short-term stock price uptick, with a 0.7% increase predicted by JFB analysts for the next ten days. While it’s not a dramatic surge, this offers hope after a four-year decline, especially with the company’s efforts to adapt to changing consumer preferences. Investors and shareholders are cautiously optimistic for a positive final quarter of the fiscal year.